Even the best-laid travel plans can take an unexpected turn, such as last-minute flight cancellations and sudden medical emergencies. Travel insurance can give you financial protection and peace of mind even when you’re far from home, but how much coverage do you need, and what risks should you get protection from?

This guide explains what travel insurance covers, how much it costs, and how to choose the right plan for your needs. Learn more about these different considerations to get the best coverage during your trip.

How Travel Insurance Works in Canada

Travel insurance is designed to protect you from unexpected expenses and financial losses that can happen while travelling, whether within Canada or abroad. Depending on your policy, it can help cover emergency medical care, trip cancellations or interruptions, lost or delayed baggage, and even repatriation to Canada in the event of a serious illness, injury, or death.

Most provincial health plans provide limited or no coverage for medical costs incurred outside your home province, and almost none for international care. This means travellers are often responsible for the full bill. In other countries, those costs can be extremely high.

Coverage can be purchased for:

- Single trips: Protection for one specific trip, with coverage dates matching your travel dates.

- Annual multi-trip plans: Covers all trips you take within a year, up to a set number of days per trip, and is often more cost-effective for frequent travellers.

Travel insurance policies are available for Canadians travelling abroad, Canadians visiting other provinces, visitors coming to Canada, international students, new immigrants, and Canadian snowbirds spending extended periods outside the country.

How Much Does Travel Insurance Cost in Canada?

The average cost of travel insurance in Canada varies between 5% and 10% of your total trip cost. However, the cost will vary depending on several key factors, such as:

- Number of travellers: Family or group coverage will cost more than coverage for a single person.

- Age of travellers: Rates typically rise with age and can increase significantly for seniors.

- Trip length: Longer trips cost more to insure than shorter ones.

- Type of coverage: Comprehensive plans with medical, cancellation, and baggage coverage cost more than medical-only policies.

- Coverage limits and deductibles: Higher coverage limits or lower deductibles generally mean higher premiums.

- Destination: Travelling to farther countries or those with higher healthcare costs will generally result in higher premiums.

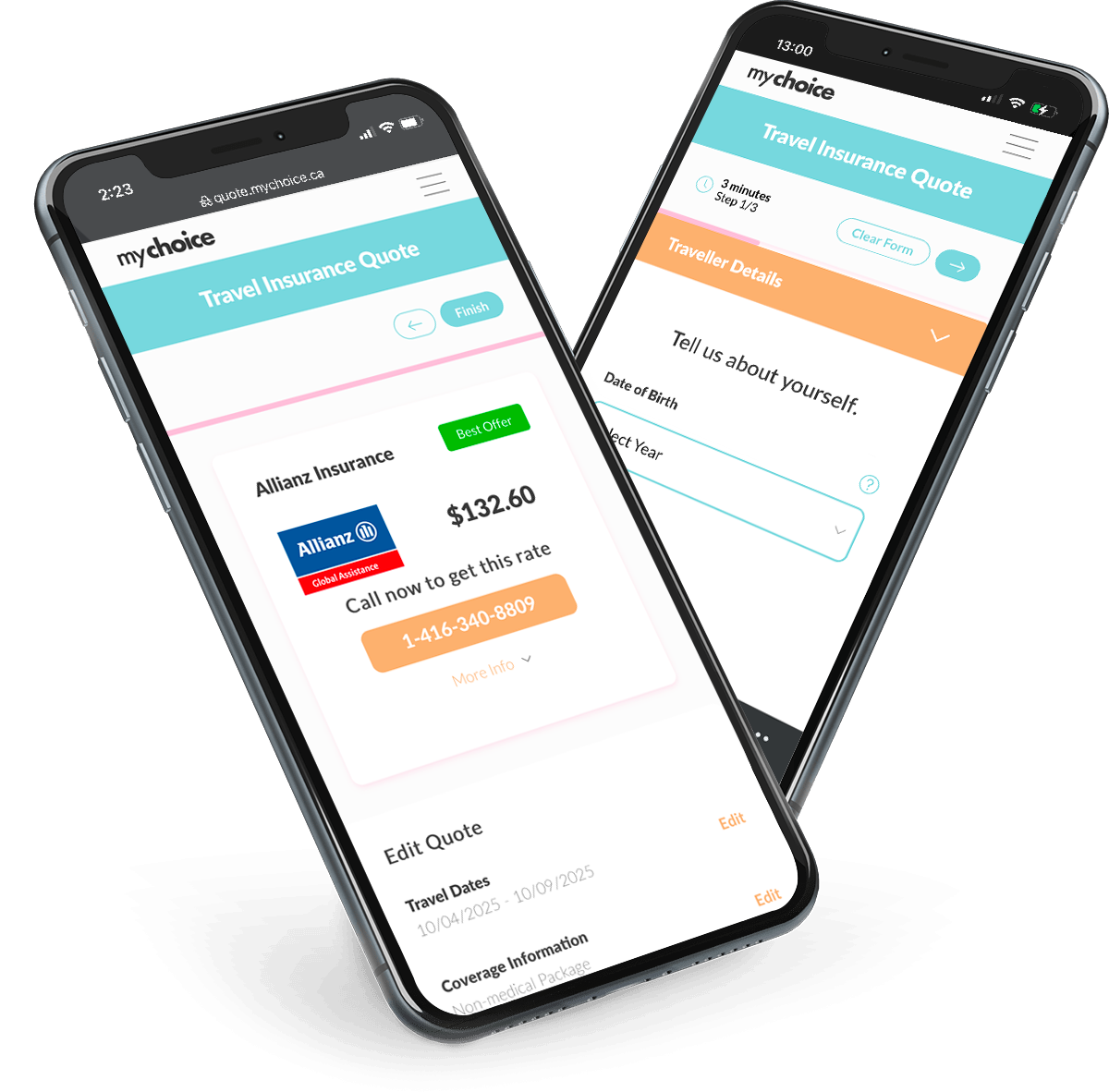

Because prices can differ widely between insurers, comparing multiple quotes is the best way to find a policy that balances cost and protection. Tailoring your coverage to your trip’s needs can help you save without sacrificing essential benefits.

Most Common Travel Insurance Coverage Options in Canada

When shopping for travel insurance in Canada, you’ll find that policies can include a range of protections. Understanding the most common coverage types helps you choose a plan that fits your destination, activities, and budget.

Here are the options you’re likely to see when comparing travel insurance:

Who Provides Travel Insurance Quotes in Canada?

There are a few different ways you can get travel insurance quotes from trusted providers in Canada. Here are four main options for comparing and purchasing coverage:

How to Get Cheap Travel Insurance

The 2025 Smart Traveller Survey revealed that 23% of Canadians said they would travel abroad without travel health insurance as a way to save money. Skipping coverage might seem like an easy way to cut costs, but it can leave you exposed to medical bills, trip cancellations, or other unexpected expenses that can be far more costly than the premium.

You can find affordable travel insurance rates without compromising essential protection by being strategic about what you buy. Here are some tips to get a good deal:

Reasons to Get Travel Insurance

Travel insurance might be required for certain trips, but many travellers should consider getting it even if their destination or visa application doesn’t make it mandatory. Here’s why it’s worth having:

What to Look For When You’re Comparing Travel Insurance in Canada

When you compare travel insurance policies, you should focus on these factors:

FAQs about Travel Insurance in Canada

What is the best travel insurance for visitors to Canada?

The best travel insurance for visitors to Canada generally depends on age, health, and length of stay. Compare multiple quotes to find the right fit, especially if you have specific concerns like a medical condition or bringing fragile or valuable items on your trip.

What is travel cancellation insurance?

Travel cancellation insurance reimburses prepaid, non-refundable travel costs if you cancel your trip for a covered reason, such as illness, injury, or a family emergency.

What should travel insurance cover?

At a minimum, your travel insurance should cover emergency medical bills. Depending on your trip, you may also want cancellation or interruption, baggage, and AD&D coverage.

Where can I purchase travel insurance in Canada?

You can purchase travel insurance in Canada through different channels, like insurance brokers, licensed agents, direct insurers, banks, credit card companies, travel agencies, and online comparison platforms. Each option offers ways to compare plans, customize coverage, and complete your purchase before your trip.

Do I get travel insurance with my credit card?

You can get travel insurance with your credit card. Many premium credit cards include travel insurance, but coverage limits, trip lengths, and conditions vary. Always read the fine print.

How do I claim travel insurance?

Generally, you can claim travel insurance by contacting your insurer’s claims department as soon as possible and following their instructions. Provide all requested documents, receipts, and medical records to support your claim.

Do I need travel insurance if I’m only going to the U.S. for a weekend?

Yes, you still need travel insurance even for a weekend trip to the U.S. in case of situations like lost luggage or delayed flights. Medical emergencies abroad are another major concern, as in the event of a sudden medical emergency, even a short U.S. hospital visit can cost thousands. Travel insurance ensures you’re not stuck with a massive bill.

Can I buy travel insurance after departure?

Yes, some insurers allow you to buy travel insurance after departure. Note that coverage might be limited and waiting periods may apply.