Whether you run a small shop, manage a construction crew, or freelance as an event planner, accidents happen and can lead to costly legal trouble. Fortunately, public liability insurance can safeguard your business by covering expenses caused by such unfortunate mishaps. But how does it work, and how does it differ from other types of business insurance?

This guide will walk you through the essentials, from costs and coverage to when it’s required and how it compares to other insurance options.

How Public Liability Insurance Works in Canada

Public liability insurance is a subset of general liability insurance designed to protect you if someone from the public (e.g. a client, customer, or visitor) suffers injury or property damage because of your business activities.

It’s often part of a Commercial General Liability (CGL) policy, designed to protect against third-party claims that aren’t from your employees. It covers legal defence costs as well as settlement or court-ordered payouts. While it’s not legally required everywhere in Canada, many contracts, venues, or industry bodies make it mandatory as an added assurance.

How Much is Public Liability Insurance in Canada?

The cost of public liability insurance in Canada varies widely. For example, a small to medium-sized business with a general liability policy with a $2 million limit typically has a starting premium of around $450 per year. But this rate can start climbing based on its industry, size, location, and risk exposure

Let’s take a closer look at what influences your public liability insurance cost:

What Exactly Does Public Liability Cover/Not Cover?

There are some risks that a public liability insurance policy won’t cover. Here’s a quick reference table showing the core protections and common exclusions:

| Covered | Often Excluded |

|---|---|

| Bodily injury to a third party | Employee injury (covered by Workers’ Compensation) |

| Property damage to a third party’s belongings | Professional errors or negligence in your work (needs Professional Liability/E&O Insurance) |

| Legal defence costs if you’re sued | Cyberattacks, data breaches (needs Cyber Liability Insurance) |

| Medical expenses for injured third parties | Damage to your own business property (needs Commercial Property Insurance) |

| Settlements or court-ordered damages | Intentional or criminal acts |

Who Needs Public Liability Insurance in Canada?

While not every business is legally obligated to carry public liability insurance, it’s strongly recommended for anyone who:

Even freelancers and sole proprietors can face lawsuits over accidents: without insurance, those legal and compensation costs come directly out of pocket.

Public Liability vs. Other Optional Coverages

Public liability is just one type of policy, and it doesn’t cover every potential risk. Here’s how it compares to other common business policies:

| Coverage Type | What It Covers | What’s Excluded | Best For |

|---|---|---|---|

| Public Liability | Third-party bodily injury and property damage | Employee injury, professional mistakes, cyber risks | Businesses interacting with the public |

| Professional Liability (E&O) | Financial loss due to professional advice or service errors | Physical injuries, property damage | Consultants, accountants, designers, IT professionals |

| Commercial General Liability (CGL) | Combines public liability with product liability and more | Professional errors, cyber incidents | Most businesses that need broader coverage |

| Cyber Liability | Losses from cyberattacks, data breaches, and privacy violations | Physical injuries, property damage | Any business handling sensitive data or operating online |

When is Public Liability Insurance Required by Law or Contracts?

In Canada, public liability insurance is not mandated at the federal level, which means there’s no nationwide law saying every business must have it. However, that doesn’t mean you can skip it. In fact, in many cases, it becomes a practical or contractual requirement depending on where you operate and what you do.

Here are common scenarios where you might need it:

Even though it’s not a blanket legal requirement across Canada, public liability insurance often becomes a practical necessity if you want to operate smoothly, win contracts, or access certain spaces. Always check your specific industry and location requirements.

What to Ask Before You Buy Public Liability Insurance

Before you commit to a public liability policy, it’s worth having a detailed conversation with your broker or insurer. A little due diligence now can save you expensive headaches later.

Here’s what you should clarify:

FAQs about Public Liability Insurance In Canada

Is public liability insurance mandatory in Canada?

No, public liability insurance isn’t mandatory in Canada. However, certain provinces, contracts, landlords, or venues may require it depending on your situation.

What’s the difference between public liability and general liability insurance?

Public liability focuses on injury or property damage to third parties. General liability (a.k.a. Commercial General Liability) is broader and includes product liability and other protections.

Can I buy a one-day public liability insurance policy?

Yes, you can buy one-day public liability insurance. Some insurers offer short-term or event-specific coverage for instances and parties such as event organizers, market vendors, and pop-up shops.

Does public liability insurance cover damage caused by employees?

Yes, public liability insurance covers damage caused by employees if it’s accidental and affects a third party. Employee injuries, however, are covered under workers’ compensation, not public liability.

Can freelancers or sole proprietors get public liability insurance?

Yes, freelancers or sole proprietors can get public liability insurance. Many insurers offer affordable policies tailored for individuals.

How do I prove I have public liability insurance to a client or venue?

You can prove you have public liability insurance to a client or venue by showing the Certificate of Insurance (COI) you received from your insurer or broker.

What’s the best insurer in Canada for public liability for small businesses?

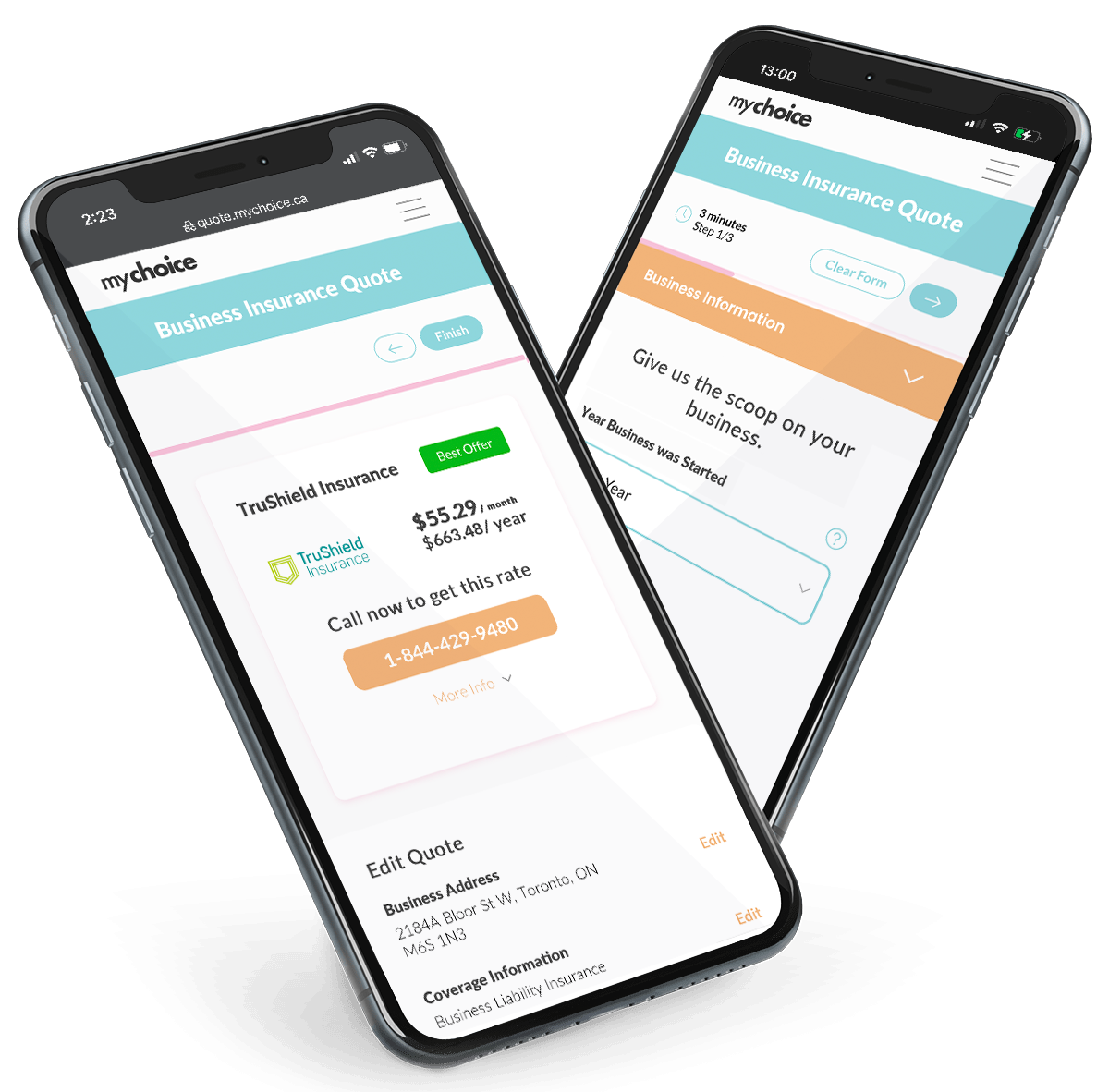

There’s no one-size-fits-all “best” insurer in Canada for public liability for small businesses, as the best fit depends on your industry and needs. Compare quotes and offered coverage using MyChoice to find the right balance between protection levels and your budget.