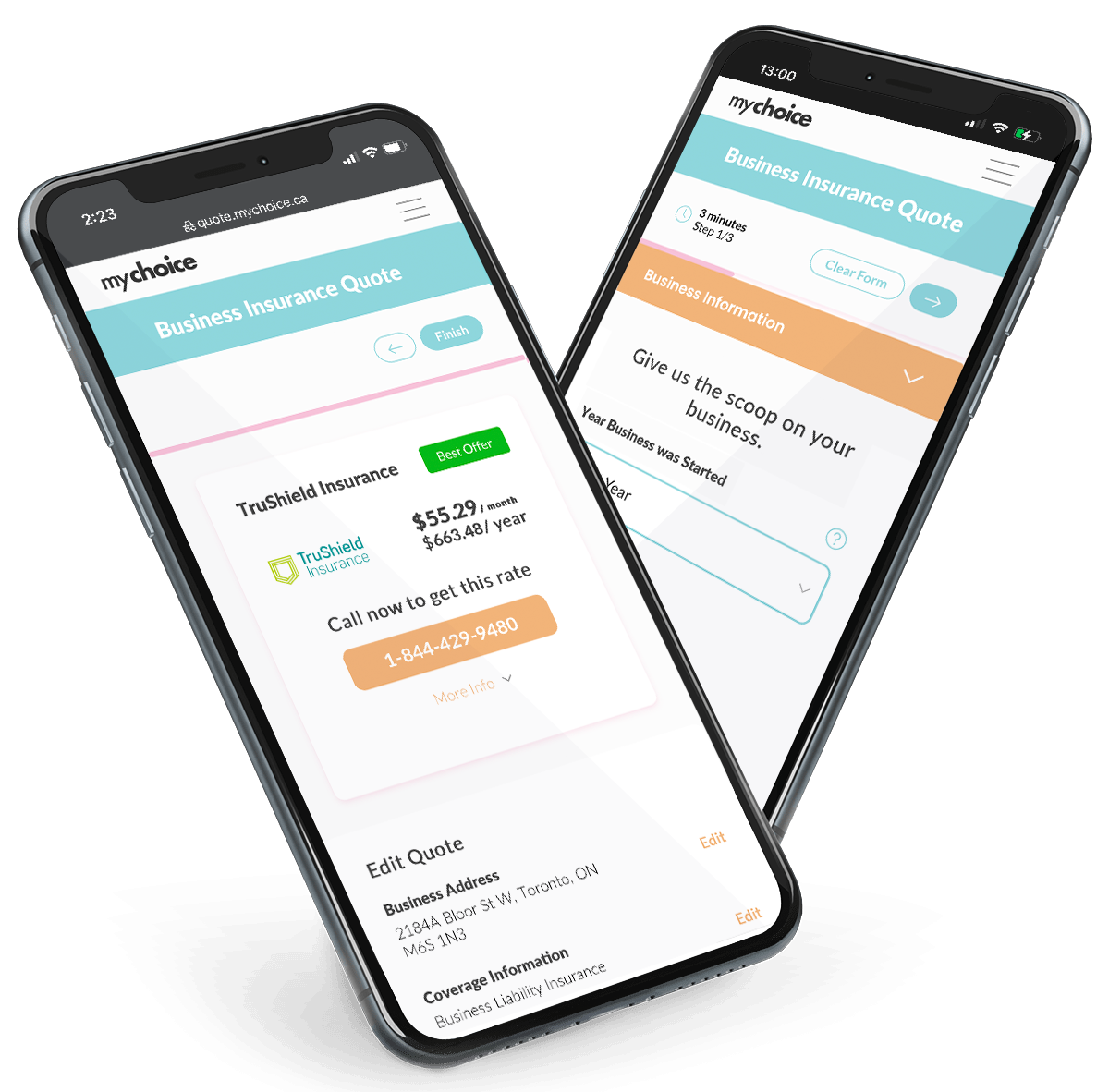

If you provide professional services or advice in Canada, professional liability insurance is one of the most important tools you can have in your business toolbox. It can save you from financial disaster if a client claims you made a mistake, gave incorrect advice, or failed to deliver what you promised.

But is it really worth it if your profession doesn’t make it mandatory, and what professions actually require this type of coverage? This guide breaks down everything you need to know about professional liability insurance, including what it covers, how much it costs, who needs it, and how to choose the right commercial policy.

How Professional Liability Insurance Works in Canada

Also called Errors and Omissions (E&O) insurance, professional liability insurance (PLI) protects you if a client claims that your professional services or advice caused them financial loss. It’s designed for anyone offering specialized services or expertise and typically covers issues such as negligence, breach of duty, misrepresentation, missed deadlines, and other service-related errors.

Note that it doesn’t cover every liability you may encounter in the exercise of your profession, but it’s still a crucial safeguard. One of the biggest reasons is that legal defence costs alone can run into tens of thousands of dollars, even if you did nothing wrong, making PLI a valuable shield for your career and business.

How Much is Professional Liability Insurance in Canada?

The cost of professional liability insurance in Canada varies widely. For a small business in Canada, the average cost of professional liability insurance typically falls between $500 and $1,500 per year, though the exact amount depends heavily on the industry and specific risk factors.

Sole proprietors generally pay a bit less, typically $400 to $800 annually, depending on their work and any past claims. Medium to large businesses can expect higher premiums, usually between $2,000 and $5,000 per year.

The industry you work in plays a major role in determining your rate. For example:

- Healthcare (e.g., doctors, nurses): $1,500 to $3,000 annually

- IT/Technology: $900 to $2,000 annually

- Consulting: $700 to $1,500 annually

- Finance and Accounting: $600 to $1,200 annually

Note that these figures are averages, so your actual premium may be higher or lower depending on your location, coverage limits, and claims history.

Factors That Impact Professional Liability Insurance Cost

The cost of PLI is shaped by a variety of factors unique to your business and the work you do. Insurers assess both the likelihood of a claim and the potential payout, which means two professionals with the same coverage limit could pay very different premiums.

Here are the main elements that can influence what you pay:

What Exactly Does Professional Liability Cover/Not Cover?

Professional liability insurance is designed for claims arising from mistakes in professional services or advice, but it doesn’t protect you from everything. Here’s a clear table breaking down typical inclusions and exclusions:

| Covered | Not Covered |

|---|---|

| Negligence (failing to meet the expected standard of care in your profession). | Criminal, fraudulent, or intentional acts, as illegal actions are excluded. |

| Breach of duty (not fulfilling your professional obligations). | Property damage is covered by Commercial General Liability (CGL) insurance. |

| Misrepresentation, where you provide false information that causes loss (even if unintentional). | Cybersecurity breaches are covered by Cyber Liability Insurance. |

| Missed deadlines where you fail to deliver on time, causing client losses. | Bodily injury (unless directly from professional negligence), as this is often under CGL. |

| Incorrect advice or planning, e.g. causing financial harm through faulty advice. | Employee disputes, which are covered by Employment Practices Liability Insurance (EPLI). |

| Defence costs such as lawyer fees, court costs, settlements, and judgments. | Contract disputes unrelated to negligence may require separate legal support. |

Who Needs Professional Liability Insurance in Canada?

If you provide professional services or advice, you should strongly consider having PLI coverage. Even if you operate as a sole proprietor or a small consultancy, you can be held personally liable for losses your clients experience due to your work.

While some professionals are legally obligated to carry this insurance, for many others it’s not mandatory but still a very smart move. Let’s break down which professions require PLI, and why even optional PLI can be a good idea:

Mandatory vs. Optional: What the Law and Clients Expect

Certain Canadian professions have regulatory bodies that require professional liability coverage as a condition of practice. The required coverage amounts and conditions vary by province and profession, but some examples include:

Failing to maintain the required coverage can result in fines, suspension, or loss of your license. But even if your coverage is optional, there will be instances where your clients may require it, such as:

Even for smaller contracts, savvy clients may insist on seeing your certificate of insurance before signing. This reassures them that if something goes wrong, there’s a financial backstop in place, and this extra assurance can give you a competitive edge over uninsured competitors.

How to Choose the Right Professional Liability Policy

Choosing professional liability insurance requires more than finding the lowest premium. The right policy balances adequate protection, relevant coverage, and sustainable cost. Let’s break down major considerations before settling on a policy for professional liability:

FAQs about Professional Liability Insurance In Canada

Can I be sued even if I didn’t make a mistake?

Yes, you can be sued even if you didn’t make a mistake, based on someone’s allegations, and disproving them can still result in legal expenses. PLI covers defence costs regardless of the claim’s validity.

What happens if I retire? Am I still liable?

Yes, you may still be liable even after retirement. Liability can persist for years after work is completed, but tail coverage can provide you with continued protection after retirement.

Is professional liability tax-deductible in Canada?

Yes, professional liability insurance premiums are generally tax-deductible in Canada as a business expense.

Does PLI cover freelancers and contractors?

Yes. Freelancers and contractors, like independent consultants, marketing contractors, and sourcing agents, can all obtain PLI coverage.

How do I prove I have coverage to a client?

You can prove to a client that you have coverage by showing them your Certificate of Insurance. Your insurer issues this and confirms your coverage limits and effective dates.

How long do I need to keep coverage after a project ends?

After a project ends, it’s advisable to keep coverage for it for a minimum of two to three years, as claims can surface well after project completion.