As a business owner, the fear of harming your customers or other third parties is a common concern. Injury and property damage lawsuits can result in substantial monetary losses and a tarnished reputation. While these incidents are unpredictable and hard to prevent entirely, you can still protect yourself with insurance, which is where commercial general liability (CGL) coverage comes in.

Let’s examine how general liability insurance works in Canada. You’ll learn the basics of how it works, what the limitations are and other essential information about this critical business coverage.

How General Liability Works in Canada

Commercial general liability insurance in Canada protects you from injury and property damage claims that come from a third party (typically customers) due to your business activities and products.

Usually, general liability insurance protects you from these potentially financially damaging claims:

- Bodily injury: Bodily harm that happened due to your business activities, such as if your customer trips on your business premises and breaks their wrist.

- Property damage: Damage to a third party’s property due to business activities, such as accidentally scratching a client’s wooden furniture while you work on renovations.

- Personal and advertising injury liability: Claims of copyright infringement or slander from your advertising or other content, such as if you accidentally included copyrighted material in an ad campaign.

- Product liability: Injury or damages caused by the products you sold, such as if a customer suffers an allergic reaction after consuming your food.

- Tenant’s legal liability: Damage done by your business to rented business premises, such as if you accidentally break the window of your office.

If you get sued due to factors covered by your CGL policy, your insurance policy will cover the legal costs and damages associated with the lawsuit, regardless of its result.

What’s important to note is that CGL insurance isn’t mandatory in Canada, and you can do business without it. But there are plenty of reasons why it’s still

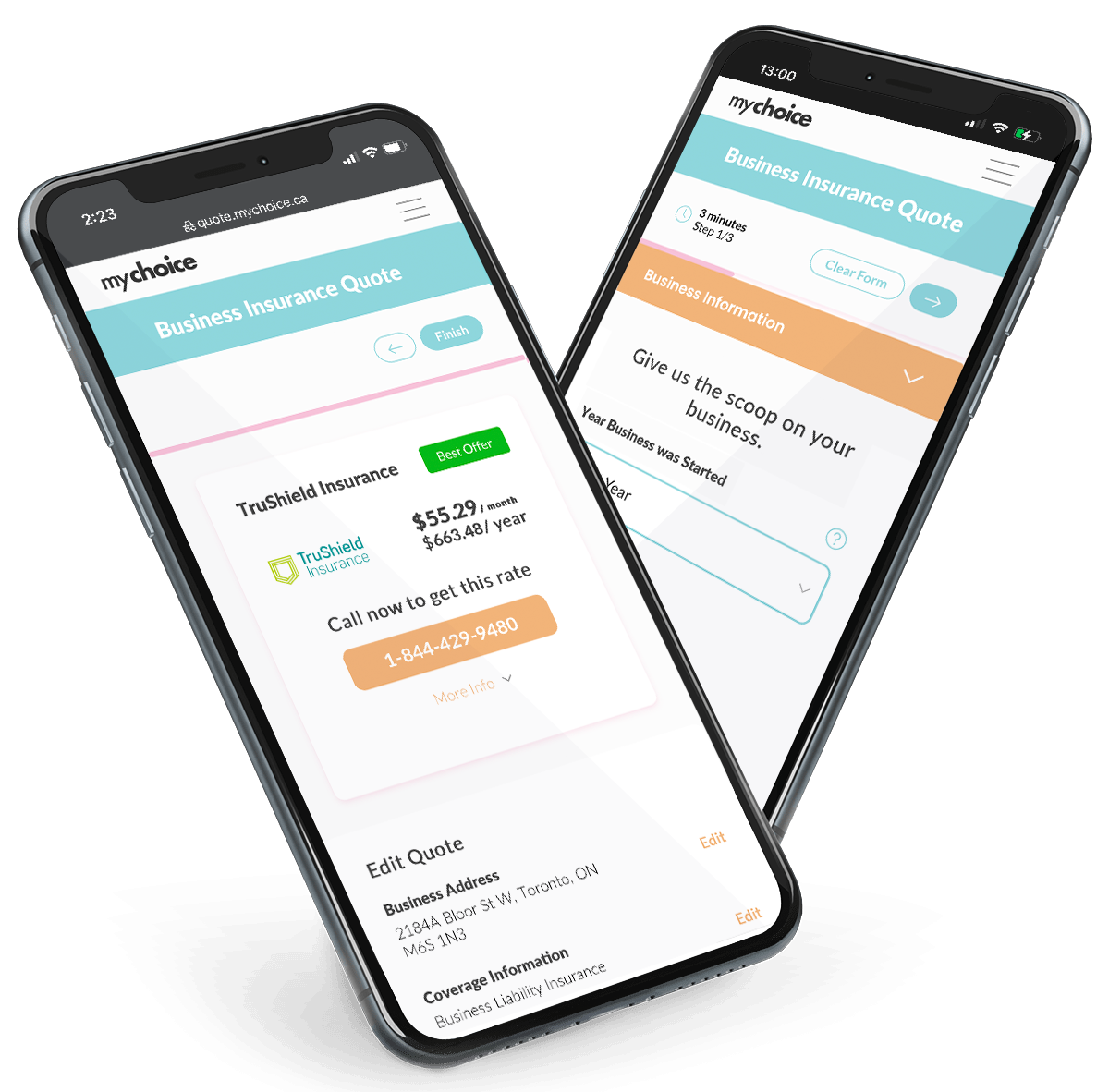

How Much is Commercial General Liability Insurance in Canada?

The commercial general liability insurance cost in Canada varies, depending on your business type and its associated risks. To give you an idea of what commercial general liability protection would cost, consider some common industries and business sectors, and common risk factors that impact their cost, as shown in the table below:

| Business Type | Typical Annual Premium | Risk Factors That Impact Cost |

|---|---|---|

| General contractor | $400-$600 | History of workplace injuries, adherence to safety standards, nature of contracting jobs taken. |

| Manufacturing | $1,300-$2200 | Type of products manufactured, history of workplace accidents, adherence to safety standards. |

| Retail | $500-$1200 | History of customer lawsuits, store location, type of products sold. |

| Food & beverage | $500-$900 | Track record of food poisoning cases, adherence to health and safety standards, business location. |

| Hospitality | $2000-$5000 | Business location, track record of customer injuries or lawsuits, building condition. |

How Much General Liability Coverage Do You Need?

The amount of general liability coverage you need usually depends on your insurance protection needs. The higher your coverage amount, the more you’ll pay annually. General liability insurance for small businesses is usually worth $1 million, but the coverage amount may vary depending on factors such as:

- Your industry/sector risk level: If your company is in a high-risk industry or sector like construction, a higher coverage amount may be a good idea.

- Business size: Larger chain businesses generally need more coverage than a single-location small business.

- Partner or client requirements: Your partner or client may request a certain amount of coverage to protect both themselves and your business if something goes wrong.

- Business location: Businesses in busy or crowded locations like shopping malls or downtown areas may need a higher coverage amount due to more foot traffic.

What Exactly Does CGL Insurance Cover/Not Cover?

CGL insurance covers many things, but it doesn’t cover everything. For a better idea of what CGL insurance covers and doesn’t cover, you can see the table below.

| Claim Type | Example Incident | Covered by CGL? |

|---|---|---|

| Personal injury | A customer slips on a wet floor and fractures their hip. | Yes |

| Property damage | Your employee accidentally breaks a client’s window. | Yes |

| Copyright infringement | You accidentally posted copyrighted material on company socials. | Yes |

| Tenant legal liability | Your rented office kitchen catches fire. | Yes |

| Legal fees | You pay a lawyer to defend against lawsuits stemming from the above incidents. | Yes |

| Employee injuries | A member of your roofing team fell off the client’s roof and broke their bones. | No, you need worker’s compensation insurance. |

| Professional mistakes | Your company provided a faulty product to a client, who suffered financial losses because of it. | No, you need professional liability insurance. |

| Damage to business property | A fire destroys your company computers. | No, you need commercial property insurance. |

| Cybersecurity breaches | Somebody hacks into your website and defaces it. | No, you need cyber insurance |

Who Needs CGL Insurance in Canada?

Generally, most businesses in Canada need CGL insurance. While this coverage isn’t mandated or a legal requirement, it’s still a very good idea to have CGL coverage because it can protect your company from suffering massive losses from an unpredictable incident.

In addition to CGL insurance, you can also consider getting other optional business coverages recognized by the IBC, like commercial vehicle insurance, professional liability, and cyber insurance, to round out your protection.

How to File a CGL Claim (And What to Expect)

A commercial general liability insurance policy falls under business insurance. However, the steps for filing CGL claims differ from the business insurance claims process outlined by the IBC.

FAQs about General Liability Insurance In Canada

Is commercial general liability insurance mandatory in Canada?

Commercial general liability insurance isn’t mandatory in Canada, but it’s still an excellent idea to get it. CGL coverage prevents you from losing lots of money on potential lawsuits, and some business partners will feel safer if your company has CGL coverage.

What is the minimum coverage I should get for CGL insurance?

There’s no strictly mandated minimum coverage for CGL insurance, but most small businesses get about $1 million worth of CGL coverage. You can adjust the coverage amount depending on your company’s needs and budget.

Does CGL insurance cover me if I work from home?

Yes, because CGL insurance provides coverage for incidents that occur beyond your home, such as if your customer is injured in their home due to your product. You can also learn more about recommended coverages for home businesses in our guide to home-based business insurance.

What’s the difference between commercial general liability and professional liability?

The key difference between general liability and professional liability is the risks each policy covers. General liability insurance typically covers physical risks, including bodily injuries and property damage. Meanwhile, professional liability covers more abstract risks, such as financial losses and missed sales opportunities.

Does CGL insurance cover my employees’ injuries?

CGL insurance doesn’t cover employee injuries. You can take workers’ compensation insurance to cover employee injuries.

Will CGL insurance cover legal fees if I’m sued?

Yes, legal fees are included in CGL insurance coverage. Regardless of the lawsuit’s result, you still receive the coverage if the claim goes through.