Renting out your home on Airbnb can be a great way to earn extra income, meet new people, and make better use of your property, but it also comes with risks. From a guest accidentally breaking your furniture to a burst pipe flooding your living room, the unexpected can happen fast. That’s why having the right insurance for your Airbnb is essential.

Let’s break down how to get insurance for your Airbnb, what it covers (and what it doesn’t), how much your commercial coverage might cost, and the policies you should consider.

How Does Insurance from Airbnb Work in Canada?

Airbnb provides something called AirCover for Hosts, which is automatically included for free. This includes:

While it may seem fairly comprehensive, AirCover is not a replacement for home, landlord, or commercial insurance. It doesn’t cover natural disasters, normal wear and tear, maintenance issues, or any damage unrelated to an Airbnb stay. It also won’t apply to bookings made outside of Airbnb’s platform. For full protection, most Canadian hosts still need dedicated short-term rental insurance.

How Airbnb Insurance Works: What’s Protected and What’s Not

Airbnb’s protection is useful, but it’s not as comprehensive as a dedicated insurance policy. Here’s a quick comparison of what’s generally covered under Airbnb’s AirCover for Hosts, and what’s not.

| Covered | Not Covered |

|---|---|

| Guest-caused property damage (furniture, appliances, valuables) | Wear and tear or maintenance issues |

| Accidental guest injuries on your property | Injuries to you or people you employ privately (e.g., cleaners) |

| Damage to your property caused by guests or their invitees | Damage caused by pets (varies by situation) |

| Theft of property by guests | Losses from pests, mould, pollution, asbestos |

| Third-party liability if a guest damages a neighbour’s property | Acts of nature (flood, earthquake) unless separately insured |

| Income lost if you have to cancel bookings due to covered damage | Losses from business interruption not related to a covered event |

Why You Need Additional Short-Term Rental Insurance

Once you list your property on Airbnb or VRBO, your home is now considered a business. That means that your home insurance will NOT cover losses tied to Airbnb rentals. In fact, if you don’t tell your insurer you’re hosting, your policy can be voided.

If you’re renting out a room, part of your home, or a dedicated investment property, short-term rental insurance is the only way to stay fully protected.

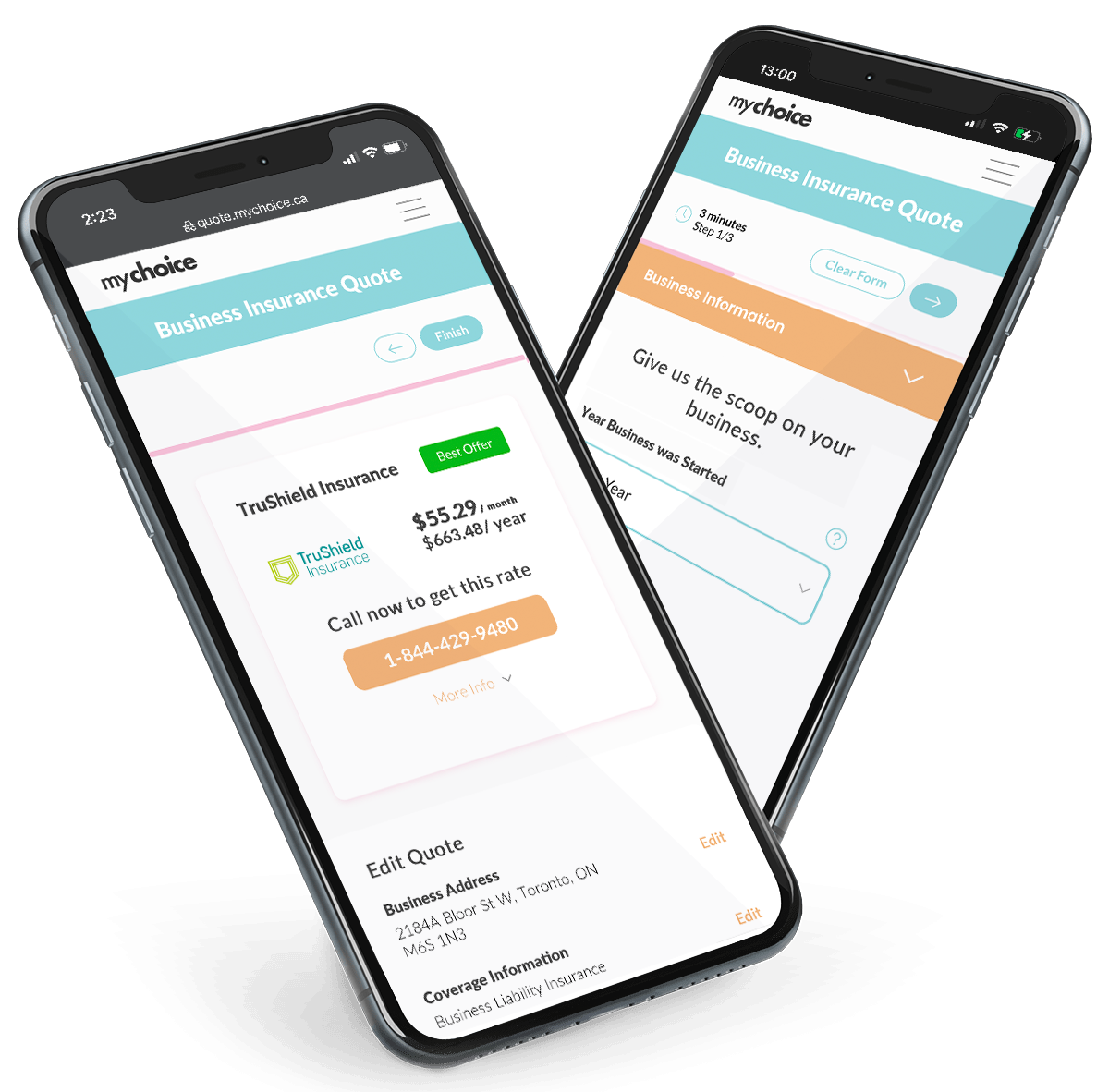

How Much Does it Cost to Insure Your Airbnb in Canada?

While Airbnb’s AirCover comes at no extra cost, most Canadian hosts choose to purchase additional short-term rental insurance for better protection.

On average, short-term rental insurance in Canada costs between $30 and $50 per month. Your exact premium depends on a variety of factors, including:

- Plan limits: Higher coverage limits usually mean higher premiums.

- Location and property type: Urban condos may cost less to insure than rural lakefront homes, but high-value markets tend to have higher rates overall.

- Size of the space: Larger homes with more rooms typically require more coverage.

- Contents: Expensive furniture, electronics, or artwork increase the replacement cost, which drives premiums up.

- Replacement cost: Insurers look at what it would cost to replace your property and its contents after a loss.

- Rental activity: Hosting year-round comes with more risk than occasional rentals, so full-time hosts may pay more.

- Claims history: A track record of prior insurance claims can raise your rates.

Because every property and host is different, the best way to know your exact cost is to get quotes from insurers who specialize in short-term rental coverage. Just remember: even if you host only occasionally, the right policy can be worth far more than its annual premium if something goes wrong.

Short-Term Rental Insurance vs. Long-Term Rental Insurance

Short-term rental insurance is designed for higher guest turnover and covers the unique risks of temporary stays. Meanwhile, long-term rental Insurance assumes stable tenants and usually excludes short-term stays unless you add a specific rider, which can be pricey.

If you rent short-term without the right coverage, your insurer could deny a claim entirely, even for unrelated incidents. Let’s compare these two further:

| Feature | STR Insurance | Long-Term Rental Insurance |

|---|---|---|

| Guest turnover | High, with guests staying weekly or even nightly | Low, as tenants stay months or years |

| Included liability | Usually higher, geared for frequent guest use | Standard landlord liability |

| Coverage for guest theft/damage | Often included | Often excluded |

| Price | Higher than long-term rental | Lower (but void if you violate terms) |

What Other Policies Canadian Hosts Should Consider

Canadian hosts often layer additional policies for greater protection. Here are some you may want to consider, especially if you plan to keep hosting Airbnb guests on your property:

Regulatory Risks You May Overlook

Canadian Airbnb hosts also have to navigate a patchwork of local laws that can cause serious headaches if overlooked. Each city, town, and even individual building may have its own rules, and the penalties for ignoring them can be costly.

In Toronto, for example, the principal residence rule means you can only list the home you live in as your Airbnb, and you must be officially registered with the city to operate legally. Vancouver has its own approach, requiring hosts to obtain a business licence and provide proof that the property is their primary residence before accepting guests.

If you live in a condo, you’ll face another layer of regulation. Many condo corporations have bylaws that either restrict or outright ban short-term rentals, regardless of what city rules allow. Even in smaller towns, you’re not necessarily in the clear, as zoning laws in some municipalities prohibit short-term rentals in residential areas entirely.

The risks of ignoring these rules go beyond fines. You could face eviction, have your listing removed from Airbnb, and, perhaps most importantly, find yourself without insurance coverage if a claim arises.

Tips to Lower Risk and Premiums as an Airbnb Host

You can’t control everything, but you can make your property less risky. Try these tips to lower both your premiums and your stress level:

FAQs about Airbnb Insurance In Canada

Is Airbnb hosting risky?

Airbnb hosting can be risky without sufficient coverage. Higher guest turnover means more opportunities for damage, noise complaints, or legal trouble if you don’t follow local rules.

Can Airbnb hosts get scammed?

Airbnb hosts can get scammed in a number of ways, including fake payment confirmations and chargebacks. Always keep all communication and payments within the Airbnb platform to be protected.

Does Airbnb cover insurance for hosts?

Yes, Airbnb covers some insurance for hosts through AirCover, but it’s limited and has exclusions. Most hosts should get additional coverage.

What if a guest gets hurt in my Airbnb?

If a guest gets hurt in your Airbnb, Airbnb’s liability coverage may apply if the injury is your legal responsibility, but only within its terms. Your own liability policy can provide more certainty and possibly more coverage if needed.