The surge in Canadian business failures that defined the post-pandemic recovery era has finally hit a ceiling, yet the resulting “relief” is creating a complex new set of challenges for the commercial insurance market. The Office of the Superintendent of Bankruptcy released data that shows a 21.1% drop in business insolvencies over the last year. This suggests a stabilizing economy, but a deeper dive into the numbers shows that the drop also masks a significant migration of risk from corporate balance sheets to the individual consumer.

A new MyChoice analysis breaks down these shifts and how they affect the nature of liability, credit risk, and business insurance as we head into 2026.

What the October 2025 Insolvency Data Actually Says

On the surface, a 21.1% drop in business insolvencies looks highly favourable for the Canadian economy. However, a deeper dive into the OSB data reveals that this isn’t necessarily a sign of “economic stability,” but rather a sign of “survivalist stabilization.” Many of the “zombie” companies that were expected to fail when government pandemic support ended have already cleared out of the system.

What remains is a leaner, but more cautious, business environment. The data shows that bankruptcy business proposals are making up a larger share of the total filings. This is a specific type of insolvency where a company asks creditors for more time or a reduction in debt instead of closing up altogether. In October 2025, these proposals stayed relatively steady compared to outright bankruptcies.

This distinction is critical for commercial insurers. An outright bankruptcy usually means a policy is cancelled and the risk disappears from the carrier’s books. A business in a “proposal” state, however, is a company under extreme financial duress that is still operating.

These businesses are often forced to cut corners to meet their new debt obligations. They might defer HVAC repairs, reduce security staff, or skip professional training sessions. This creates a “hidden risk” profile: the business looks active on paper, but its physical and operational risk is actually increasing because it is “under-maintained.”

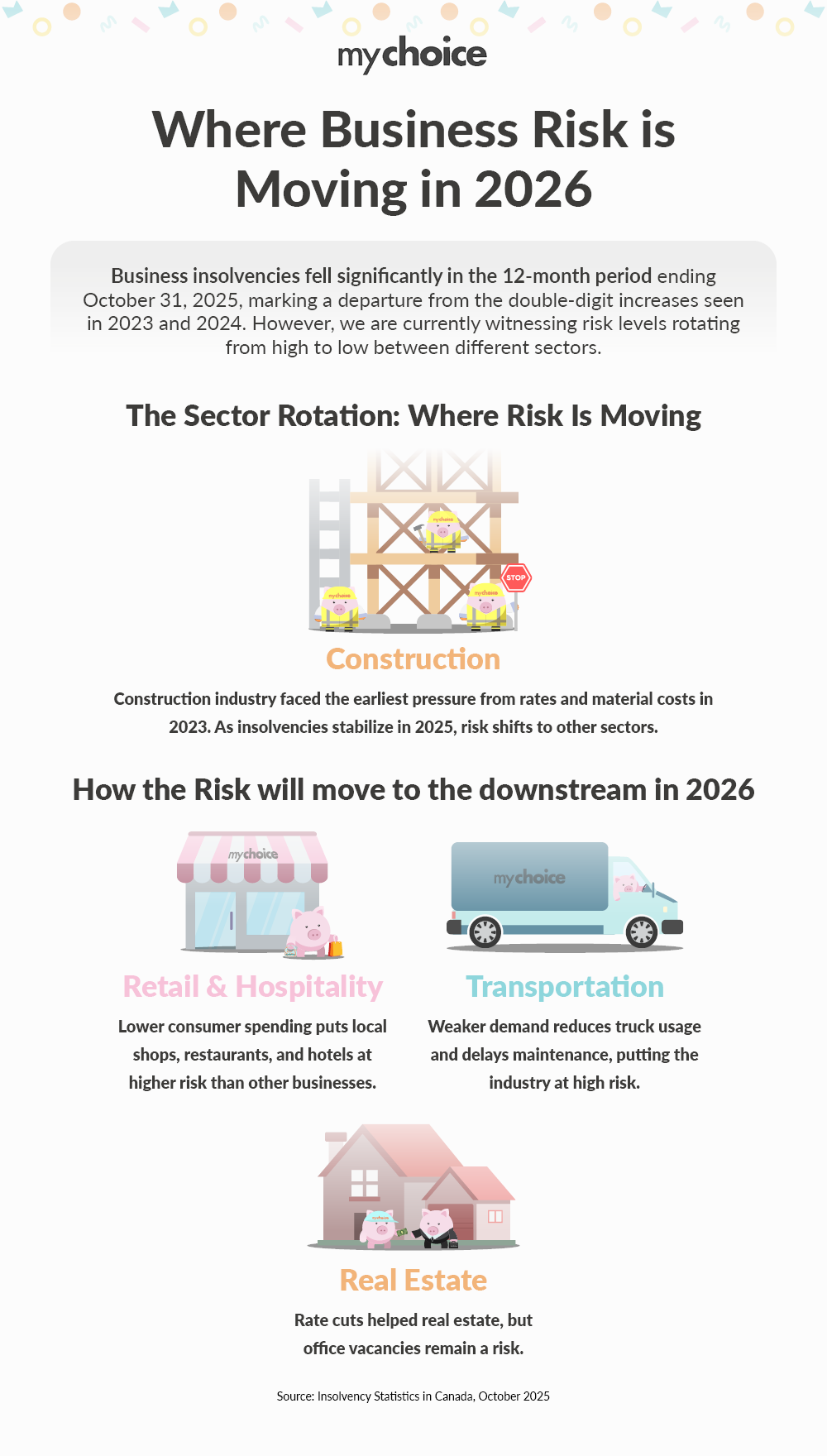

The Sector Rotation: Where Risk Is Moving (and Why That’s Noteworthy)

We are currently witnessing risk levels rotating from high to low between different sectors. In 2023 and 2024, the construction industry was the primary victim due to rising interest rates and material cost inflation. By late 2025, construction insolvencies began to plateau. However, the stress has moved downstream. Here’s a quick look at where risk has since moved:

What This Means for Commercial Insurance Underwriting

As we move into 2026, the downward trend in bankruptcies will not automatically lead to lower premiums. In fact, the underwriting process is likely to become more surgical. Here is how the industry is reacting:

Key Advice from MyChoice

- When renewing your commercial insurance policy, show that your business is financially stable. If you’ve invested in safety upgrades or new tech despite the tough economy, highlight it. This proves to your insurer that you are proactively managing risks and could help you qualify for lower rates.

- Avoid cutting back on professional training or preventative maintenance. Insurers are quick to decline applications or issue non-renewals if they see a spike in small, preventable claims that suggest operational neglect.

- If you find a favourable rate in early 2026, ask about multi-year “rate locks.” While the market may be better for your current industry in 2026, factors like climate-driven natural catastrophe losses could cause rates to pivot quickly by 2027.