Starting a business comes with a lot of risks, but you can protect yourself by planning ahead. Investing in insurance is a simple yet strategic way to give your startup the best chance at succeeding because it protects you from unexpected circumstances, like natural disasters or potential labour claims from employees.

In Canada, startups have an average 3.9% survival rate in their first 5 years, and poor financial and risk management is a big contributor to why so many of them fail. Any experienced entrepreneur will tell you that business insurance can help ease the mental and financial strain of building a company from the ground up.

Keep reading to learn the dos and don’ts of getting business insurance and how you can get the right coverage to start on the right foot as a new business owner.

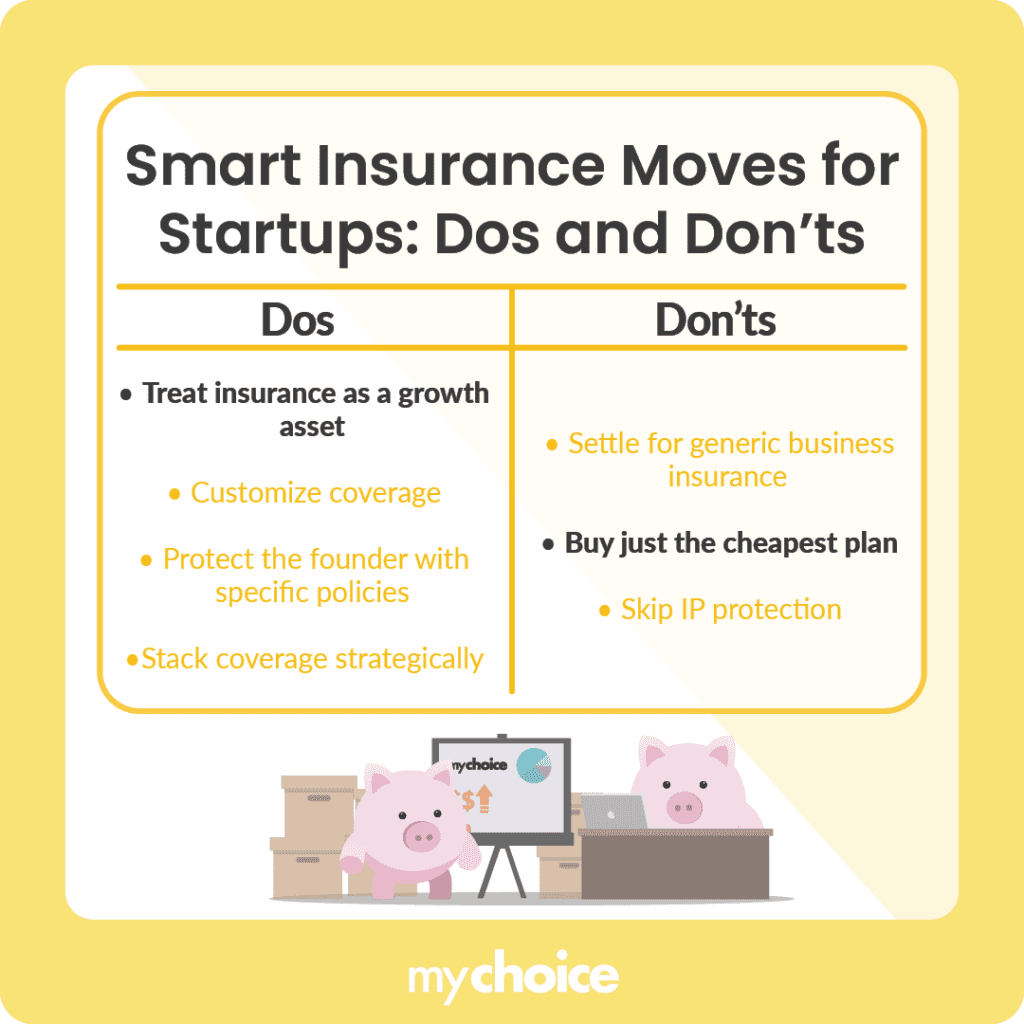

Choosing the Best Insurance for Your Business: Dos and Don’ts

There is no one-size-fits-all insurance plan for a business, but there are some general guidelines and tips you can follow. Here are the dos and don’ts of choosing insurance plans to make sure all your bases are covered as you build your startup.

Do: Treat Insurance Like a Growth Tool, Not Just Risk Management

Having insurance from the get-go shows potential investors, employees, and customers that you’re serious about running a credible and stable business. When you can reassure stakeholders that your startup can handle the inevitable challenges a new business will face, you develop a reputation for being trustworthy and reliable. As a result, your business will grow steadily as you reach more people.

Don’t: Default to Generic Small Business Insurance

Generic business insurance won’t cut it if you want to beat the odds and build a successful startup in Canada. Do your due diligence by researching the situations you may find yourself in and the options you can explore to resolve them. You need to be proactive in planning so you can tailor your insurance coverage to address risks that are specific to your line of business.

For example, many AI startups get coverage to protect them from hardware theft or office damages but might overlook other important coverage needs, like data liability, where customers’ personal information is illegally shared with third parties. They should also watch out for unexpected legal costs from model misuse risks wherein customers can file lawsuits if they believe an algorithm model incorrectly profiled or discriminated against them.

Do: Understand Which Policies Actually Protect You, the Founder

As a business owner, you have the most to lose if things go south. While you put in the effort to grow your startup, you should remember that your responsibility isn’t just to handle business affairs but to keep yourself safe and understand how certain situations affect you as the founder. Here are some insurance coverage plans to look into:

Don’t: Just Buy the Cheapest Policy Online

Don’t just buy insurance for the sake of having it. In Canada, startup business insurance costs can range anywhere from $400 to $1,200. While it might be tempting to skimp on insurance to cut down on expenses, it’s counterintuitive to buy it if it doesn’t actually help your business. Instead, browse through articles about insurance certificates, policies, and coverage options to make informed decisions that benefit your startup long-term.

Do: Time Your Insurance Around Key Milestones

Gradually expand your insurance coverage – you don’t need all of them set up right away. You can follow a timeline for the necessary insurance coverage for each stage of growing your startup. Remember that you need to get these before you hit the actual milestone to file claims:

- Get the D&O insurance when you’re raising funds to build the startup.

- Get EPLI when you’re ready to release job postings to find your first employees.

- Get professional liability insurance before you do a product launch.

- Check for contract-mandated coverage like cyber and general liability insurance when you’re ready to begin pitching to big clients and sign them on.

Don’t: Forget IP-Related Coverage

If you’re building a tech, design, writing, SaaS, or AI startup, make sure that you own the intellectual property (IP) and are protected with IP insurance to cover potential legal fees. This coverage helps you defend yourself against a legal case if someone contests your IP rights to specific patents, designs, codes, or trademarks.

Note that Canada’s Copyright Act states that freelance creators own any work they produce unless there’s a contract indicating otherwise. So, if you hire a freelance designer to create a logo for your startup, they need to explicitly confirm in writing that they agreed to hand over the rights of their work in exchange for monetary compensation.

Do: Stack Coverages Strategically

Stacking insurance policies helps you get the most coverage possible. It’s best to inquire with multiple insurance providers because they may offer bundled coverage plans at discounted prices for startups. Generally, a strong starter pack combination includes D&O insurance, EPLI, professional liability insurance, and cyber liability insurance. On top of that, you need to add on the specific coverage that is tailored to your business profile.

Key Advice from My Choice

- As a new business owner, it pays to be proactive. Don’t wait until you experience an unexpected lawsuit or huge financial losses before you invest in insurance. The best way to build a resilient startup is to stay a step ahead and have multiple solutions ready to counter the many risks that come with having a business.

- Document everything from the earliest stages of building your startup to the present. You can’t properly file insurance claims without proof, so stay organized. You can even create digital copies of any original physical paperwork to build a library of backup files.

- Routinely do a risk assessment of your startup. If you find gaps in your current coverage, research riders or other supplementary forms of coverage you can add to strengthen your overall insurance.