For many small business owners in Canada, cybersecurity can seem like a “big company” problem. But today’s cybercriminals are targeting smaller businesses more than ever, and when a breach happens, the financial and operational fallout can be far more serious than most owners expect.

Why Small Businesses Are Now Prime Targets

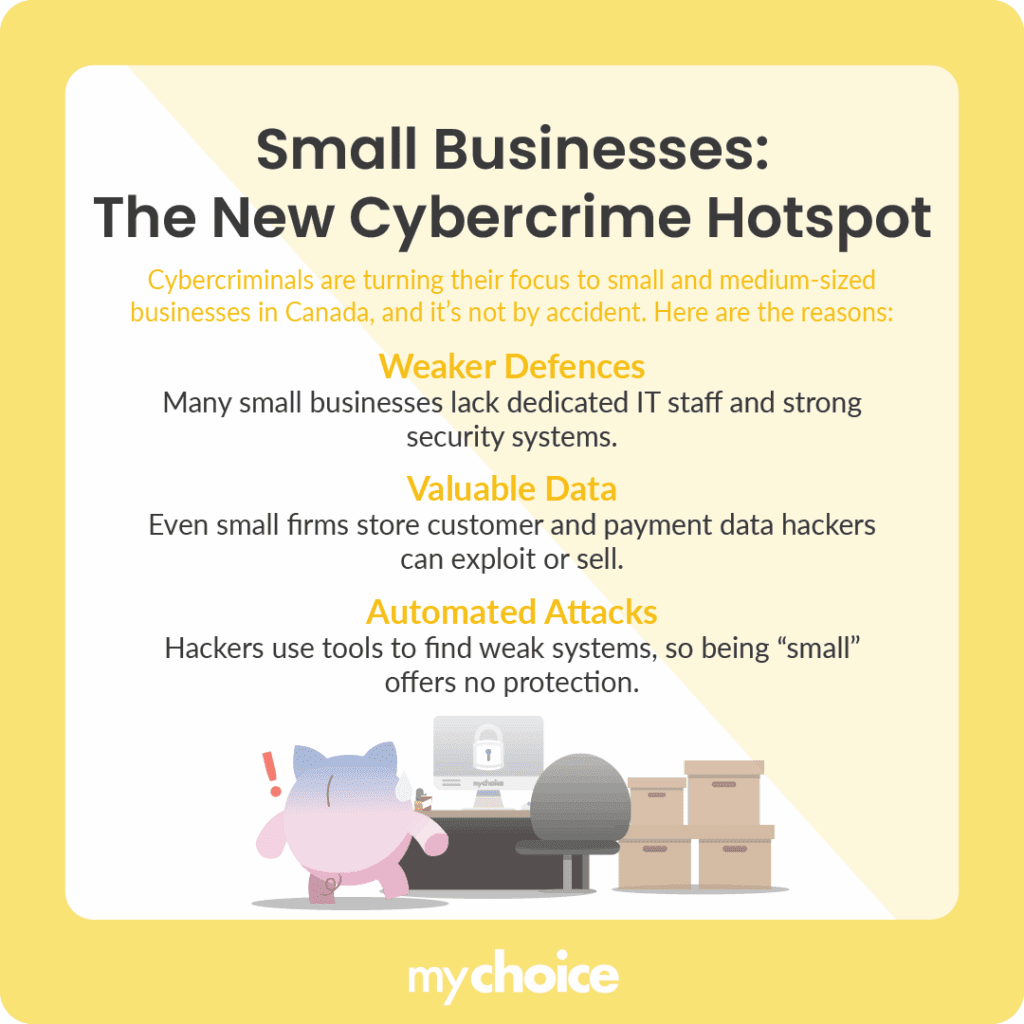

Today, small and medium-sized businesses (SMBs) in Canada have become the new favourite targets for hackers because they’re easier to breach and often less prepared to respond. Let’s break down the biggest reasons why small businesses across Canada are now prime cybercrime targets:

- Automation of attacks: Attackers use software tools that sweep for unpatched systems or weak credentials automatically, so being “small and off the radar” no longer protects you.

- Lower defences: Smaller businesses often lack dedicated IT or security staff, sophisticated monitoring, or strong malware and patching procedures, making them easier to attack.

- Valuable data: Even a small business holds customer data, billing records, and supplier info, which are all things attackers can easily exploit or sell.

Preventing a Data Breach: What You Can Do Today

If you’re an SMB owner, here are things you can do to protect your business:

How Cyber Insurance Premiums Compare to Potential Losses

Basic cyber-liability insurance for small Canadian businesses can start at $500 to $1,000/year. Compared to the cost of a breach reaching $100,000 or more, the benefit becomes clear.

If you pay $1,000/year for insurance and reasonable cybersecurity measures, and that helps you avoid or reduce a breach costing $100,000 or more, that’s still high value. In other words? Premiums are modest relative to potential losses, so it makes sense for most small Canadian businesses to at least look into cyber insurance.

The True Cost of a Data Breach for Businesses in Canada

When a data breach hits, the impact isn’t limited to just paying for IT fixes or replacing a few computers. The costs stack up quickly, and they can hit every corner of your business. Let’s break down the key areas where Canadian small businesses feel the biggest impact:

Key Advice from MyChoice

- Outdated software is one of the easiest ways hackers get in. Schedule regular updates for operating systems, apps, and antivirus software.

- Limit access to sensitive information. Not every employee needs access to all your systems or customer data.

- Change default router passwords and ensure your business Wi-Fi is encrypted.