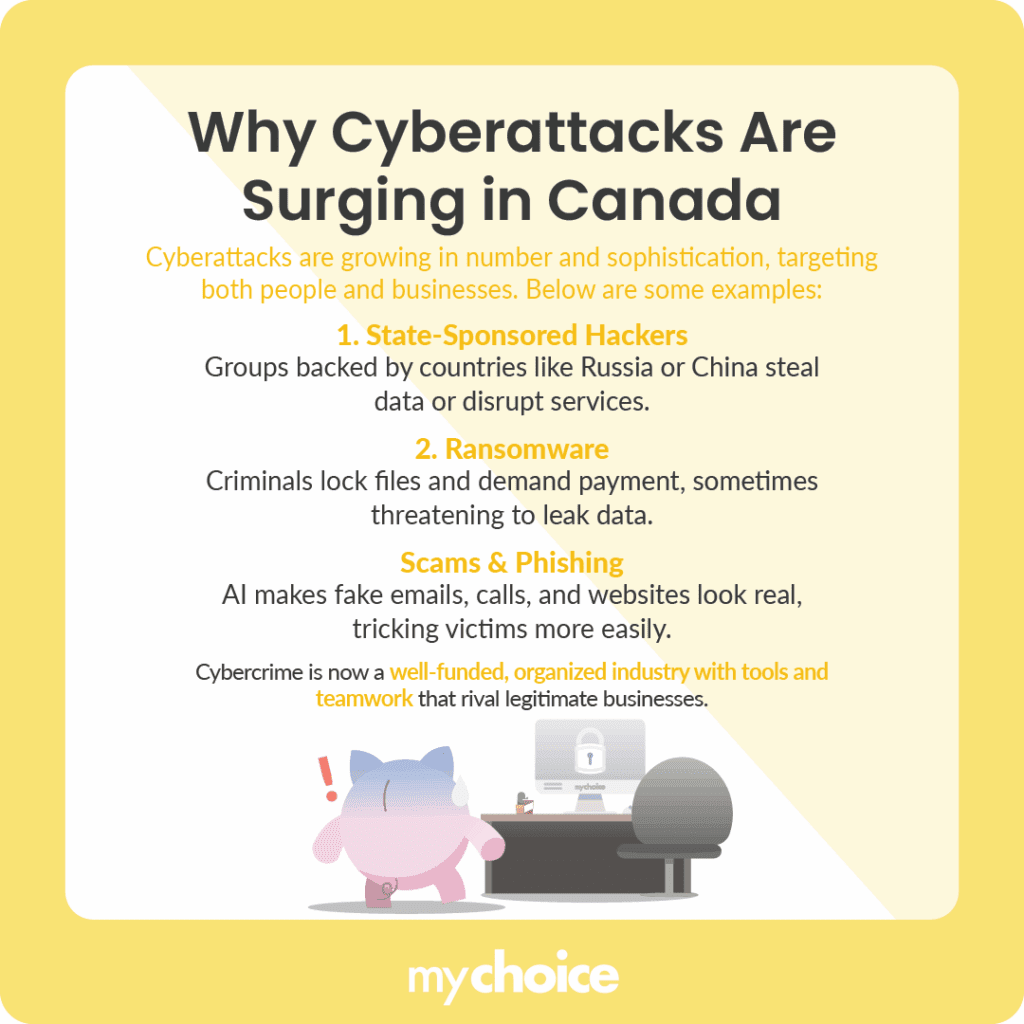

Cyber threats are on the rise in Canada, from ransomware shutting down businesses to scams that trick everyday Canadians. Let’s break down what’s driving the increase, the current state of cybersecurity in Canada, the everyday risks businesses face, and the practical steps you can take to stay protected.

Why Cyber Threats Are Escalating in Canada

The National Cyber Threat Assessment of 2025–2026 makes it clear: the cyber risks facing Canadians are bigger than ever.

Cybercrime has become more professional than ever. They’re organized groups, often working together, with resources and tools that rival legitimate businesses.

The State of Cyber Security in Canada Today

Canada has made some progress with cybersecurity. The Canadian Centre for Cyber Security has been issuing regular updates, providing practical advice, and working with businesses to build resilience. New laws, like the Critical Cyber Systems Protection Act, are also designed to protect essential services such as banking, telecommunications, and energy.

But despite these efforts, many Canadian organizations remain vulnerable. Small and medium-sized (SMEs) businesses in particular often don’t have the budget or in-house expertise to put strong protections in place. Basic issues like outdated software or reused passwords continue to be the weak spots that attackers look for first.

Another challenge is underreporting. Many cyber incidents never make it to the headlines, either because businesses are embarrassed, worried about reputational damage, or simply don’t know where to report them. This means the numbers you may see only show part of the picture.

Cyber attacks can have a ripple effect across the country. For example, hospitals hit with ransomware have had to cancel surgeries and delay care. Because so many parts of the Canadian economy are interconnected, a single weak link can expose many others.

What Are Everyday Risks for Businesses?

For Canadian businesses, cyber risks are especially serious because they can disrupt operations, damage customer trust, and drain finances. Here are some of the most common threats you need to watch for:

- Phishing scams: Fake emails or texts posing as banks, suppliers, or even the CRA trick staff into sharing passwords or clicking malicious links.

- Ransomware: Criminals lock critical files and demand payment, threatening to leak data if you refuse.

- Business Email Compromise (BEC): Fraudsters spoof executive emails to push through fake payments or request sensitive data.

- Third-party risks: Vendors, software providers, or contractors with weak security can expose your systems.

- Human error: Mistakes like weak passwords remain leading causes of breaches.

A cyber incident can mean:

- Financial losses from stolen funds, ransom payments, or downtime.

- Legal and regulatory trouble if sensitive customer data is exposed.

- Reputation damage that erodes customer trust and costs future sales.

- Operational disruption that leaves staff unable to work and customers waiting.

What You Can Do to Protect Your Business

You don’t need to be an expert to lower your risk. Here are practical steps every Canadian business can take:

- Use strong passwords and MFA (multi-factor authentication).

- Update your software regularly, as patches often close security holes.

- Back up your data in a secure location so ransomware can’t hold it hostage.

- Train employees to spot scams and suspicious emails.

- Limit access. Remember, not everyone needs full admin privileges to your online resources.

- Have a response plan ready in case of an attack.

- Get cyber insurance. This coverage can help with the costs of recovery, legal help, customer notifications, and more expenses related to cyber threats.

Cyber insurance is a financial safety net. While it doesn’t replace strong security practices, it makes bouncing back from an incident easier.

Key Advice from MyChoice

- Check whether your business insurance policy includes cyber insurance to cover issues like data breaches, ransomware, and business interruption.

- Make sure vendors, contractors, and partners you rely on also follow good cybersecurity practices, since their weaknesses can become your weaknesses.

- Know who to call, how to communicate, and what steps to take if a cyber attack happens. Quick action limits damage.