Working for yourself as a consultant gives you more freedom, but also more responsibilities that an employer would otherwise be handling on your behalf. One of the smartest moves you can make to protect your business and peace of mind is to get the right insurance coverage. Business insurance for your consultancy isn’t just a safety net. It’s an essential part of running a resilient, professional business that’s prepared for sudden costs.

What Are My Business Insurance Options as a Consultant in Canada?

Here’s a breakdown of the most relevant insurance types for consultants in Canada:

| Insurance Type | What It Covers | Best For |

|---|---|---|

| Professional Liability (Errors & Omissions) | Legal costs and damages if a client claims negligence, bad advice, or missed deadlines | Any consultant providing advice or services |

| Commercial General Liability (CGL) | Injuries or property damage caused to third parties at your workplace or theirs | In-person meetings, co-working spaces, client site visits |

| Cyber Liability Insurance | Costs related to data breaches, hacking, or stolen client information | IT consultants, marketers, anyone handling client data |

| Business Contents Insurance | Physical contents of your home office or business location | Home-based consultants with valuable equipment |

| Portable Electronics Coverage | Laptops, tablets, and smartphones on the go | Remote workers, travelling consultants |

| Business Interruption Insurance | Lost income if your business is temporarily shut down due to covered events | Consultants relying on physical space or equipment |

| Legal Expense Insurance | Legal advice and coverage for business-related legal disputes | All consultants, especially if contracts are involved |

| Directors & Officers (D&O) Insurance | Claims made against directors or executives for mismanagement | Incorporated consultants with a board or employees |

| Intellectual Property (IP) Infringement Add-On | Defense against claims of IP theft or unintentional infringement | Creatives, marketers, designers, developers |

Is Consultant Insurance Tax Deductible?

Yes, insurance premiums for a consultant’s business purposes are typically tax-deductible in Canada. The Canada Revenue Agency CRA) allows you to deduct the cost of most business-related insurance from your self-employment income. This includes:

- Property and contents insurance for your home office

- Professional liability premiums

- Cybersecurity-related coverage

Just make sure the policy is strictly for your consulting business activities, and keep receipts and policy documents on file in case you ever need to submit them to the CRA.

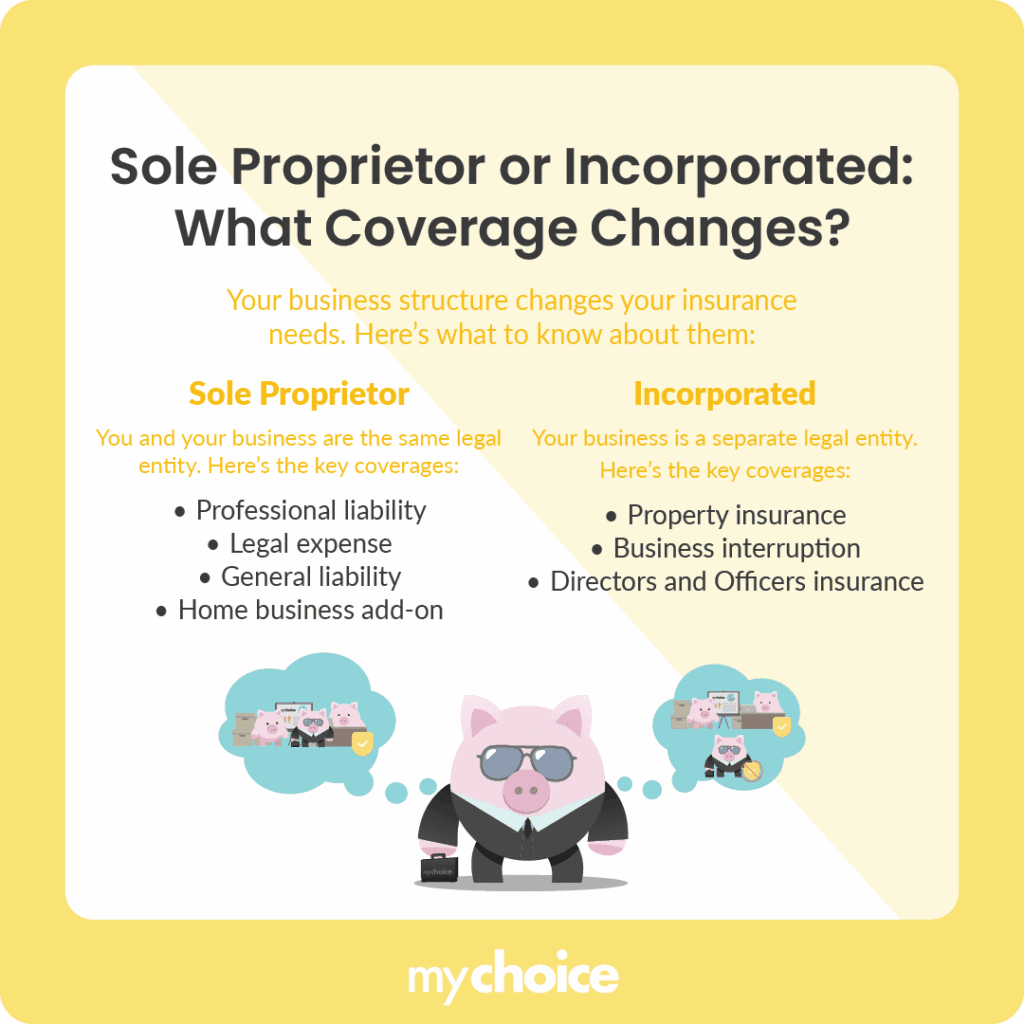

Sole Proprietor vs Incorporated: Does Your Insurance Strategy Need to Change?

Your insurance strategy definitely changes depending on the way your consulting business is structured, as it will significantly impact your legal responsibilities, financial risk, and ultimately the kind and amount of coverage you need. Let’s take a closer look at the difference each structure makes:

Common Mistakes to Avoid When Choosing Consultant Insurance

Many consultants get insurance once, then never think about it again. However, this leads to a few pitfalls you definitely need to look out for:

Key Advice from MyChoice

- Think about how and where you work when choosing insurance for your consultancy business. For example, if you’re often on the road, it may be a good idea to get portable electronics coverage. If you’re creating digital assets, consider IP protection.

- If you work from home, part of your home insurance premium may also be tax deductible, but only the portion related to business use. Talk to a tax adviser to get exact figures for this.

- Some insurers offer specialized coverage for things like intellectual property disputes or contract reviews. These add-ons can be worth it if you’re in a creative or legal-heavy industry.