One of the obstacles to small business growth is money. While you have skills, expertise, and a great team, your business can’t properly grow without funding. Fortunately, you can find various small business grants in Canada to jumpstart your growth.

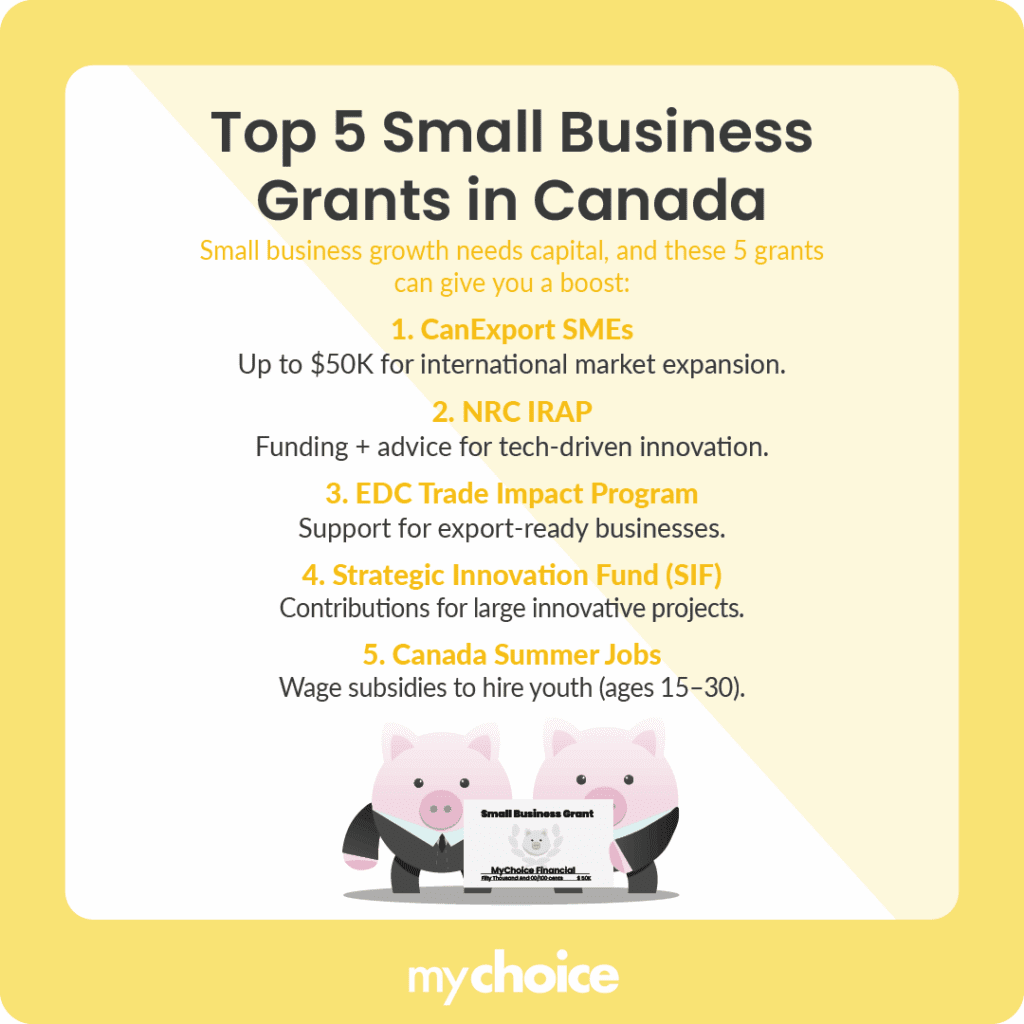

Top 5 Canada Small Business Grants in 2025

There are many small business grants in Canada that you can apply for and qualify for. To help you pick, we’ve narrowed it down to five top choices. Check the table below for a quick reference guide to our top five grants available for Canadian small businesses.

| Grant Name | Best For | Highlights |

|---|---|---|

| CanExport SMEs | Businesses exporting goods or services to other countries. | Provides international business assistance and grants up to $50,000 to cover the costs of exporting goods and services. |

| The National Research Council of Canada Industrial Research Assistance Program (NRC IRAP) | Innovative SMEs. | Provides funding and advisory services for companies pursuing tech-driven innovation. |

| Export Development Canada (EDC) Trade Impact Program | Businesses preparing for export or already exporting. | Provides grants for export preparations and advisory services to export-ready SMEs. |

| Strategic Innovation Fund (SIF) | Innovative industrial and technology businesses. | Provides repayable contributions for innovative projects that help grow the country’s economy. |

| Canada Summer Jobs | Small businesses looking to hire youths. | Provides a wage subsidy to hire Canadians aged 15 to 30 for summer jobs. |

Grant Match: What’s the Best Grant for Your Business Type

Many business grants for small businesses are sector-specific, so what works for another company may not work for yours. If you’re looking for grants in specific sectors, look no further than this table.

| Grant Name | Category | Highlights |

|---|---|---|

| Export Development Stream – Creative Export Canada | New startups | Provides grants and contributions for new and early-stage export companies to help them expand into international markets. |

| Scientific Research and Experimental Development (SR&ED) | Tech and R&D | Tax incentives for Canadian businesses that conduct R&D in the country. |

| CanExport SMEs | Export businesses | Provides grants for export businesses selling products and services abroad. |

| The National Research Council of Canada Industrial Research Assistance Program (NRC IRAP) | Manufacturing | Offers funds for technical and research-oriented projects to support productivity improvements and product design efforts. |

| Sustainable Canadian Agricultural Partnership (Sustainable CAP) | Agri-food and rural | Multiple agriculture-related grant programs. |

| Clean Technology Manufacturing (CTM) Investment Tax Credit (ITC) | Green businesses | A refundable tax credit to encourage investments in clean technology manufacturing and processing. |

| Women Entrepreneurship Strategy (WES) | Women-led | Provides grants, loans, training, mentorship, and networking opportunities for women-led businesses. |

Grant Match: Province Specific Grants

In addition to national grants, you can also look into provincial grants to expand your grant selection. Let’s take a look at some province-specific grants you can find in Ontario, Alberta, British Columbia, Manitoba, and Saskatchewan.

| Grant Name | Province | Highlights |

|---|---|---|

| Starter Company Plus | Ontario | A government grant for new businesses that includes advice, workshops, networking, and mentorship. |

| Canada-Alberta Productivity Grant | Alberta | Grant that covers a portion of employee hiring and training costs, which are applicable to existing employees and unemployed Albertans, up to a maximum of $100,000/year per company. |

| B.C. Employer Training Grant | British Columbia | Grant that covers 80% of employee training and upskilling costs, up to $300,000/year. |

| Paid Work Experience Tax Credits | Manitoba | A tax credit program for employers that provide work experience opportunities for students in the province. |

| Saskatchewan Technology Startup Incentive | Saskatchewan | A tax credit program to incentivize the creation of tech startups to create new products and provide new jobs in Saskatchewan. |

Hidden Costs and Limitations to Watch For

While obtaining a grant can be very helpful, you still need to remember that it isn’t free money. Here are some hidden costs and limitations that you need to be aware of when pursuing and obtaining a grant:

How to Write a Winning Grant Application in 2025

A well-written, captivating grant application is one of the most crucial things in winning a grant. Grant applications are where you can tell the potential funder why you deserve to win that grant, and the more convincing it is, the better your chances are likely to be.

Here are some top tips to write a winning grant application:

- Understand the grant requirements and guidelines: The grant guidelines and requirements generally contain the preferred format and objective of the grant program, two pieces of information that are essential to crafting a great grant application. Additionally, some grants may have extra requirements, such as having to own a business insurance policy.

- Write a memorable narrative: People love stories, so use your grant application to regale the funder with the story of why your business is a great fit for the grant, weaving in points about how your business fits the grant program’s mission.

- Highlight the impact: Grants are given in hopes of enacting positive change. Use your application to paint a picture of how your business can effect change that’s in line with the grant’s objectives.

- Break down your budget: While future plans are good, grants are still ultimately about money, and the funder wants the reassurance that their money will be used wisely. Make a budget breakdown to account for all business expenses to show them that the money will be put to good use.

Key Advice from MyChoice

- Before applying for a grant, do some research to ensure it aligns with your business objectives and needs.

- The competition for a business grant is often very fierce, so make sure you showcase your company as best as you can to attract the funder’s attention.

- Not all grants come in the form of monetary awards. Some come as tax incentives or other types of financing.