Commercial property owners and businesses that manage multiple sites, buildings, or risk exposures often face a challenge: balancing adequate protection against cost and administrative complexity. Blanket coverage can be a lifesaver in such cases, providing more insurance flexibility while reducing coverage gaps.

Let’s break down how this works, its various types, and why blanket policies are becoming more popular.

What is the Purpose of Blanket Coverage?

Blanket coverage is a policy structure where multiple assets, locations, or exposures are lumped together under a single limit, instead of insuring each item or location individually.

When you have multiple buildings, properties, or insured items, a blanket policy lets you “pool” these under one umbrella limit. If one location is damaged, the coverage draws from that common pool rather than being limited to a per-location amount.

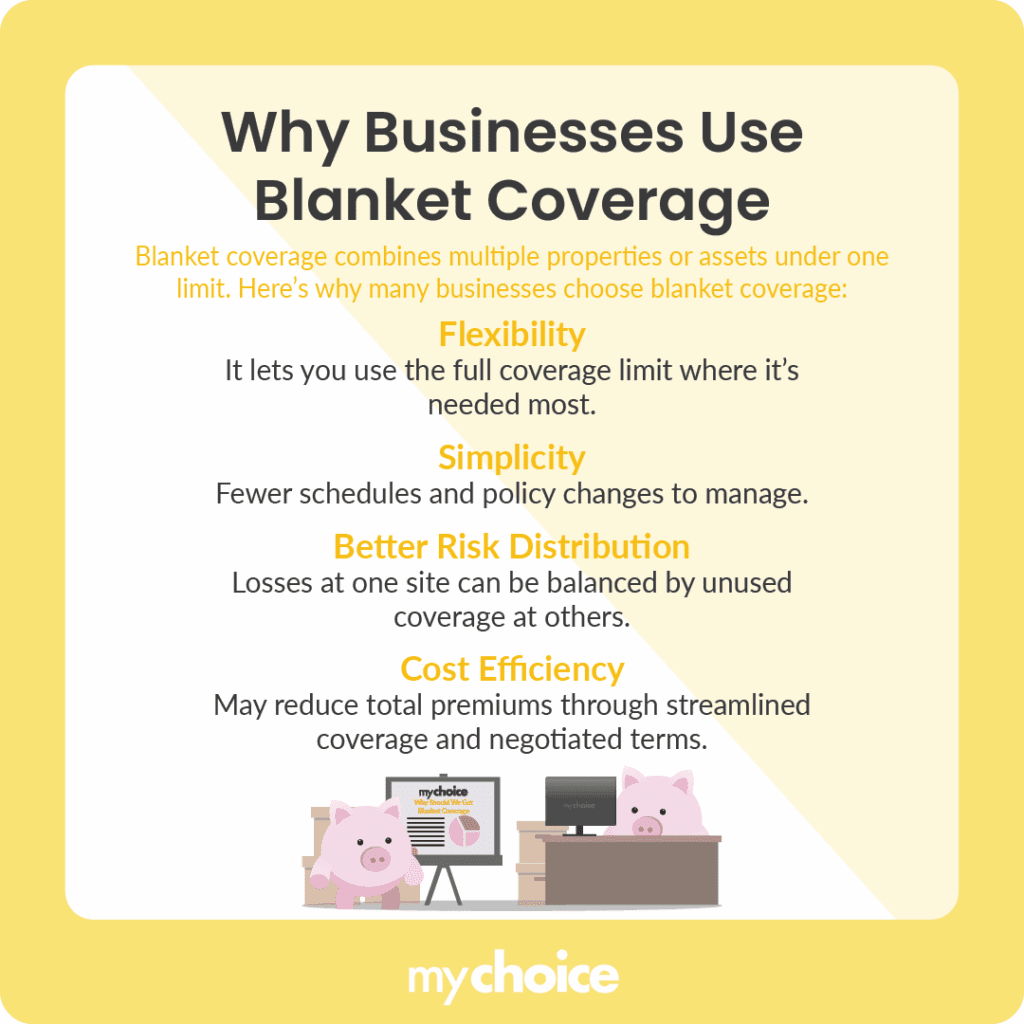

There are several reasons business or property owners might prefer a blanket approach:

How Does Blanket Coverage Work?

Here’s a rough outline of how you apply for blanket coverage and how it works:

- You list all the assets, locations, or exposures you want to cover under the blanket policy.

- The insurer and you agree on a blanket limit across all covered locations.

- You also may agree to a coinsurance clause (e.g., 80%, 90%, or 100% coinsurance), which requires you to insure a certain percentage of the total value of your combined assets. If your insured value falls short, a penalty may apply in the event of a loss.

- If a loss occurs, whether for any one building, for contents, or across multiple locations, the claim draws against the blanket limit rather than a fixed location cap.

- In some structures, you may also have sub-limits or “floater” limits per location or per type of asset (e.g. contents, stock, equipment), but still within the umbrella.

Types of Blanket Coverage

Beyond commercial real property, there are other kinds of blanket coverage or blanket endorsements in commercial insurance. Here are a few:

Blanket vs. Standard (Specific) Coverage

One of the clearest ways to see the tradeoffs is via direct comparison. Here’s a table comparing blanket coverage against standard coverage (a.k.a. specific coverage):

| Feature | Blanket Coverage | Standard/Specific Coverage |

|---|---|---|

| Number of Policies/Schedules | One umbrella policy (or fewer schedules) that pools assets | Multiple schedules or separate policies, each listing individual assets or locations |

| Coverage Limit | One combined limit for all covered locations/assets | Separate limits set per location or asset |

| Flexibility | Losses at one site can draw from unused capacity elsewhere | Each site is capped at its own limit; no cross-site sharing |

| Premiums | May sometimes be slightly higher per dollar insured, but has administrative cost savings | Sometimes lower per asset, but more overhead and complex to manage |

| Risk | Risk of one big loss consuming much of the pool; correlation risk | Losses are isolated; limited to individually insured item or location |

The Hidden Math: How Blanket Insurance Works in Real Claims

Let’s walk through a hypothetical but realistic example to illustrate the mechanics and math:

Example: You own three commercial buildings.

- Building A replacement cost: $1,000,000

- Building B replacement cost: $1,000,000

- Building C replacement cost: $1,000,000

Total combined value = $3,000,000.

You decide to take a blanket property insurance policy with a total limit of $2,700,000 (i.e. 90% coinsurance).

Unfortunately, Building B catches fire and is destroyed. The rebuilding cost is $1,000,000 for B:

- The claim draws against the blanket limit, so you have $2,700,000 available.

- After paying $1,000,000, the remaining limit is $1,700,000 for potential future claims.

- You still have coverage left for other buildings; you’re not rigidly locked to $1,000,000 for B alone.

If you used scheduled coverage, Building B might have been insured for, say, $800,000. You’d be out of pocket for the remaining $200,000 (unless there’s a co-insurance penalty or underinsurance clause). Under the blanket, that “excess need” is drawn from the common pool.

Another more extreme scenario: if two of the buildings are partially damaged in a single event (like a localized earthquake), you can submit two claims, but the total cannot exceed the blanket limit combined.

While this may seem like every business owner should just have a blanket policy, that’s not always the case. If your actual replacement cost rises (e.g. upgrades, additions), but you don’t update the blanket insured amount, you run the risk of underinsurance or penalty under the coinsurance clause. Also, if one catastrophic event damages all three buildings, the limit may not be enough, leaving you with uncovered losses.

This shows how your coverage “breathing room” depends on careful estimation of total insured value and leaving a sizeable margin for unexpected spikes or acquisitions.

Why Blanket Policies Are Becoming More Popular in Canada

More Canadian businesses are turning to blanket insurance as they expand and manage multiple locations. Instead of juggling separate policies, a blanket policy combines all properties under one overall limit. This makes coverage simpler and easier to manage.

It’s also more flexible. When you buy a new building or renovate an existing one, blanket coverage can often extend protection automatically, helping you avoid coverage gaps during transitions.

Blanket policies also help with risk management. Insurers assess the entire portfolio rather than each site individually, and a shared limit gives extra breathing room against inflation and rising construction costs. This reduces the risk of underinsurance.

What Are Some Other Examples of Blanket Policies?

Blanket policies are used beyond coverage for property damage and liability. Here are more examples of blanket or “blanket-style” insurance:

Not all of these are common or easy to obtain, but the structural principle is the same: pooling exposures under one limit or policy umbrella instead of dividing and isolating.

Key Advice from MyChoice

- Watch for correlations and large single losses. If one event could damage multiple sites, that risk should be considered in your blanket coverage limit.

- Set sub-limits for items like equipment or contents to keep one asset from using too much of your total coverage.

- If you get a blanket policy, include “newly acquired” or “automatic addition” clauses that automatically extend it to newly acquired assets. This reduces the need for constant manual updates.