Expanding your Canadian business into the United States can open up access to a massive market and potentially higher revenue. But it also means stepping into a different regulatory, legal, and insurance environment. Here’s a practical guide to help you understand what to expect and how to protect your business when expanding into the U.S.

Why U.S. Expansion Changes Your Insurance Needs

Your business insurance policy in Canada might not automatically cover your operations in the U.S., or it might have restrictions for cross-border work. Even if it does extend coverage, the limits and terms may not match what’s required in the states where you operate.

U.S. business environments also bring:

In summary, expanding to the U.S. often means your current insurance setup needs an overhaul.

Key Coverages You May Need to Consider

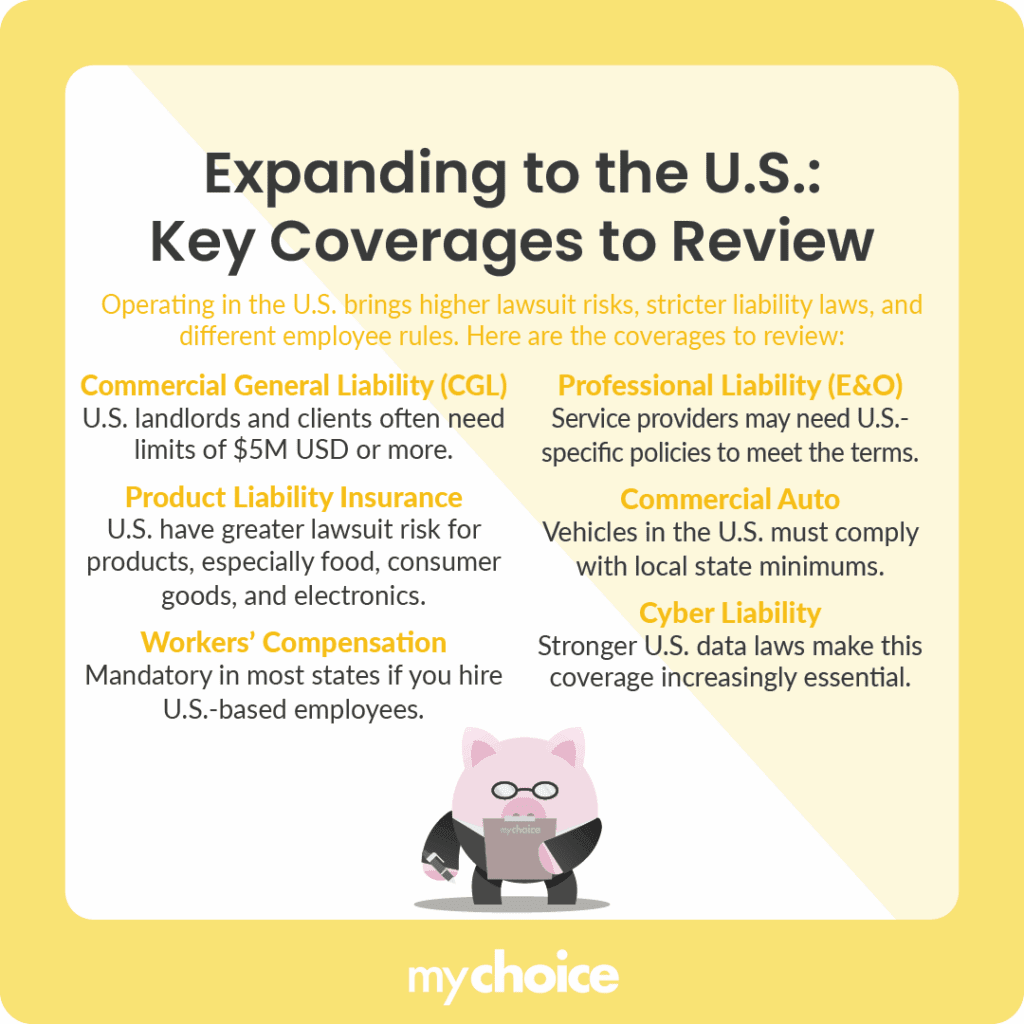

Even if you already have comprehensive coverage in Canada, operating in the U.S. often means higher limits, additional policies, and meeting specific state requirements.

Here are some of the main coverages you should review when entering the U.S. market:

Regulatory Compliance by State

Expanding to the U.S. is also complicated by the fact that different states have different state-level compliance laws. Here’s a closer look at issues you’ll need to keep in mind:

It’s not enough to just “get U.S. insurance”; you need to make sure it’s compliant in each state you do business in.

Privacy, Cybersecurity, and Data Risk

Canadian privacy laws like PIPEDA are already strict, but several U.S. states go even further, especially California (CCPA/CPRA) and New York (NY SHIELD Act). If you collect, store, or process data from U.S. customers, you may face obligations such as:

- Notifying affected individuals quickly after a breach (often within 30 days)

- Giving consumers rights to access or delete their data, which may require changes to your internal systems and processes

- Meeting specific security standards for storing sensitive information, including encryption and access controls

Cyber liability insurance in the U.S. can help cover:

- Data breach investigation and notification costs, including legal guidance and PR support

- Ransomware payments and negotiations when systems are locked or data is stolen

- Regulatory fines are insurable, which can vary by state and by the nature of the incident

Key Advice from MyChoice

- If you’re planning to expand into the U.S., you’ll need to budget for higher insurance costs. U.S. coverage often comes with higher premiums due to litigation risks.

- Review contracts before signing. Many U.S. clients have specific insurance wording and minimums written into agreements.

- Plan for state-by-state compliance. If you’re operating in multiple states, ensure your coverage meets each jurisdiction’s rules.